Why KYC Matters

Imagine a bank with no idea who its customers are. Criminals could easily launder money (hiding the source of illegal funds) or finance terrorism. KYC helps prevent this by ensuring institutions know who they are dealing with. It is like checking someone's ID before letting them into a club or a company building which is essential for security.

The KYC Process: Unmasking the Mystery

KYC involves a series of steps:

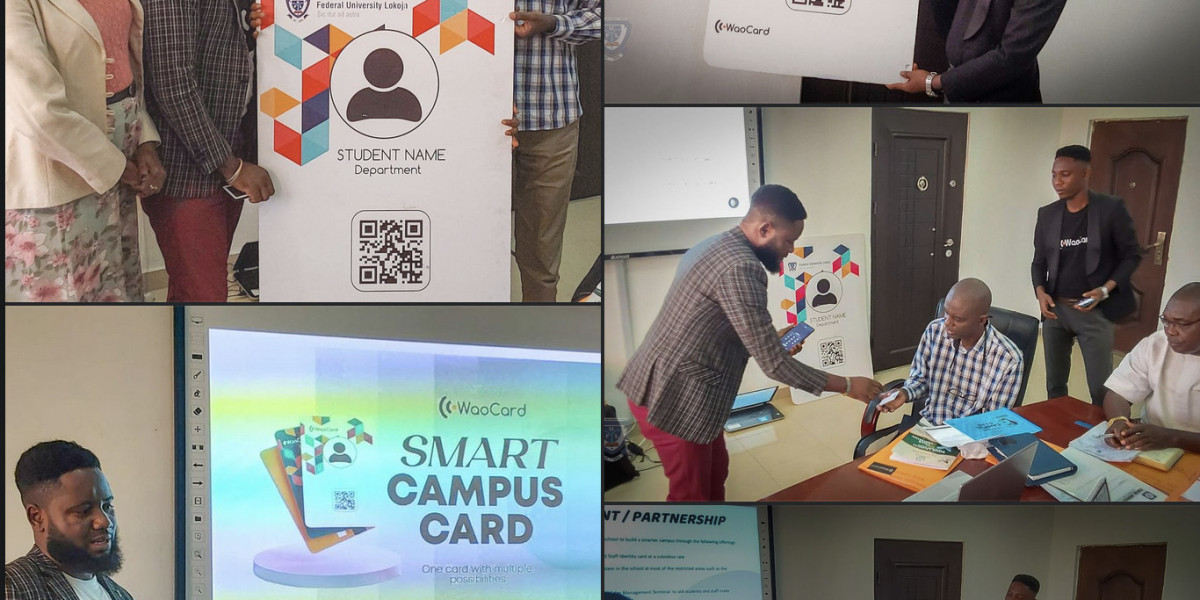

- Customer Identification: You provide basic info like name, address, and date of birth. This establishes who you are.

- Verification: The fun part! The institution checks your ID (passport, driver's license) to confirm it matches the information you provided.

- Understanding Your Business (For Businesses): Businesses may need to provide details about their ownership and activities. This helps assess potential risks.

- Continuous Monitoring: KYC is not a one-time thing. Banks need to stay updated on your financial activity, especially if your situation changes.

The Benefits of KYC: It is Not Just About Catching Crooks

KYC is not just about stopping crime. It also benefits you in this way:

- Safer Financial System: KYC helps create a more secure financial system for everyone.

- Combats Fraud: It makes it harder for criminals to steal your identity or money.

- Financial Products Tailored to You: By understanding your financial situation, banks can offer products that better suit your needs.

Beyond the Basics: Diving Deeper into KYC

The Different Levels of KYC:

KYC requirements can vary depending on the customer and the risk they pose.

Here's a simplified breakdown:

- Simplified KYC: This applies to low-risk customers, often involving basic ID verification for smaller transactions.

- Standard KYC: This is the most common level, requiring a government-issued ID, proof of address (utility bill), and possibly additional information for higher transaction amounts.

- Enhanced KYC: For high-risk individuals or businesses, extensive verification might be needed, including source of income and background checks.

The Challenges of KYC:

Despite its benefits, KYC has its challenges:

- Complexity: Regulations can be intricate, making KYC compliance a burden for institutions.

- Data Privacy Concerns: Collecting and storing personal information raises privacy concerns. Balancing security with data protection is crucial.

- Technological Hurdles: Implementing robust KYC systems requires ongoing investment in technology and expertise.

The Future of KYC: Innovation and Collaboration

The future of KYC is bright, with a focus on innovation and collaboration:

- Advanced Technologies: Biometric verification (using fingerprints or facial recognition) and artificial intelligence can streamline the process.

- Regulatory Alignment: Standardising regulations across borders can simplify compliance for global institutions.

- Collaboration between Institutions: Sharing information securely can help identify suspicious activity more effectively.

The Future of KYC: Going Digital

The traditional paper-based KYC process can be slow and cumbersome. Thankfully, technology is changing the game. e-KYC (electronic KYC) uses digital tools to verify your identity quickly and securely.

KYC: A Necessary Step for a Secure Financial Future

KYC might seem like a hassle, but it is vital to maintaining a safe and healthy financial system. By working together, financial institutions and customers can create a secure environment for everyone to thrive.

The Takeaway:

KYC plays a vital role in safeguarding the financial system. By understanding its purpose, its complexities, and its future trajectory, you can be a more informed participant in the financial world. Remember, a secure financial system benefits everyone.